- A $200B GSE MBS purchase briefly boosted mortgage pricing, but the market reaction ran far ahead of the limited details and risks creating another distortion.

- The size of the program is modest relative to the $13T mortgage market, making timing and pace far more important than the headline number.

- The impact will hinge on execution details, including whether Ginnie Mae bonds are included and how quickly the capital is deployed.

- Hedging behavior may ultimately determine effectiveness, as risk transfer could significantly mute the intended mortgage rate relief.

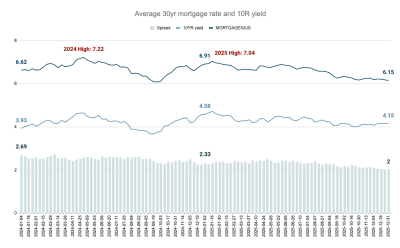

Just as mortgage spreads began to normalize, news of a $200B MBS purchase by the GSEs shook the market within minutes. The move disrupted mortgage bond pricing across all products because when you give the market something to work with, it delivers every time. While the bond rally was short-lived, both government and conventional products benefited from the GSE buying announcement, despite the bond market having no clarity on whether Fannie and Freddie will also purchase GNMA bonds. These blind reactions to what may or may not happen almost always guarantee a distortion down the line. The magnitude of that distortion is what matters most and will ultimately depend on the details of the purchase.

While the GSEs buying mortgage bonds as a non-economic buyer should help mortgage pricing and address affordability concerns, how this plan is executed is far more important than the plan itself. For now, no details have been released that offer insight into what potential mortgage rate relief could look like, if any.

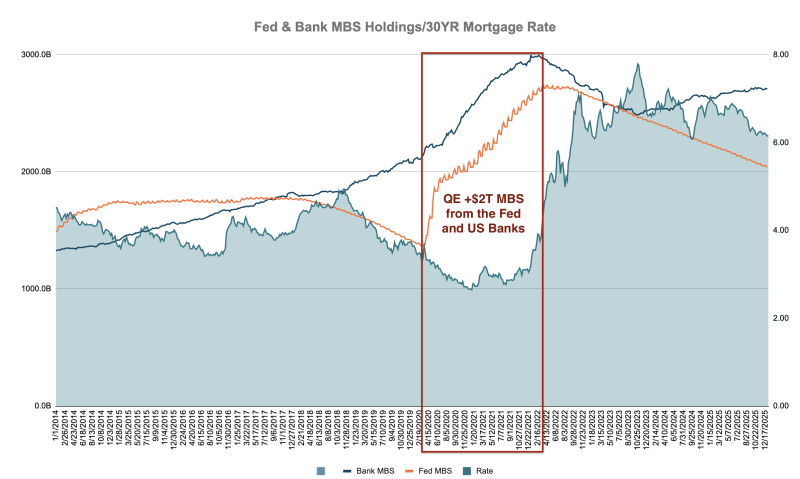

To gauge the potential impact of the $200B, it helps to compare it to the most recent price-insensitive MBS buyers, the Fed and the banks. During the most recent QE era, the Fed purchased roughly $1T of mortgages, while banks added a similar amount to their portfolios. On a cumulative basis, what the GSEs may buy equates to roughly 10% of the relief generated during the “super” QE era. While that amount may appear insignificant, the pace of the buying could make all the difference.

Currently, Fannie and Freddie combined hold about $75B of MBS. With an additional $200B, their holdings would reach levels last seen in 2016, when mortgage rates were under 4%. Outstanding mortgage debt was also roughly $4T lower in 2016 than it is today, meaning $200B carried far more weight then than it does now, especially after the distortions caused by the 2020 QE cycle. To meaningfully change the trajectory of mortgage rates, the $200B would need to be deployed in one quarter or less, with additional buying to follow. Otherwise, this will likely register as a short-lived blip that fades quickly.

The type of bonds the GSEs choose to purchase as part of the $200B investment will also influence how the mortgage market responds. Ginnie Mae bonds are not currently part of the standard GSE portfolio. Purchasing them would represent a departure from typical market operations. Given the stated focus on affordability, it is reasonable to expect the GSEs could be directed to buy Ginnie Mae bonds as well, since those securities directly support borrowers most impacted by rising housing costs.

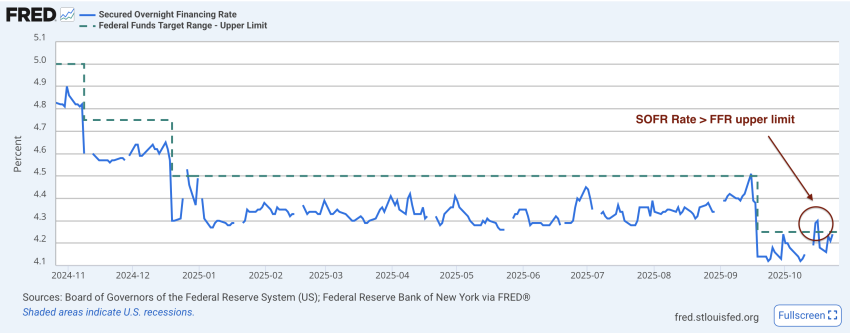

The final and perhaps most important detail is whether the GSEs will hedge the $200B portfolio. Financial disclosures suggest that both Fannie and Freddie have historically hedged their MBS holdings and continue to manage interest rate risk to stabilize earnings. While they earn a spread on MBS holdings, the associated risk is passed back to the market through hedging. This effectively neutralizes much of the impact of MBS buying because while supply is removed, duration risk is simultaneously reintroduced. This is materially different from the Fed and banks, which purchased MBS without hedging, allowing mortgage rates to respond more directly to the buying pressure. Whether the GSEs will hedge this new portfolio remains unknown, but if they do, the overall impact will be muted.

In the end, the headline number matters far less than the mechanics behind it. Without clarity on timing, product selection, and hedging behavior, the $200B announcement risks becoming more noise than signal. The market reaction has already shown how sensitive pricing is to even the suggestion of support, but sustained relief will require more than optimism. Execution will determine whether this moment reshapes mortgage rates or simply adds another chapter to an already distorted market.

Leave a Reply